CA Intermediate Exams September 2025: Complete Guide 📚

Introduction 🎯

The CA Intermediate September 2025 Exams are a crucial step for aspiring Chartered Accountants (CAs) 🧑💼. Conducted by the Institute of Chartered Accountants of India (ICAI), this exam tests students on accounting, taxation, law, and auditing.

In this blog, we’ll cover:

✔ Important Dates 📅

✔ Eligibility Criteria ✅

✔ Registration & Exam Fees 💰

✔ Subjects & Syllabus 📖

✔ Exam Pattern & Passing Criteria 📝

✔ Preparation Tips 🚀

Let’s dive in! 💡

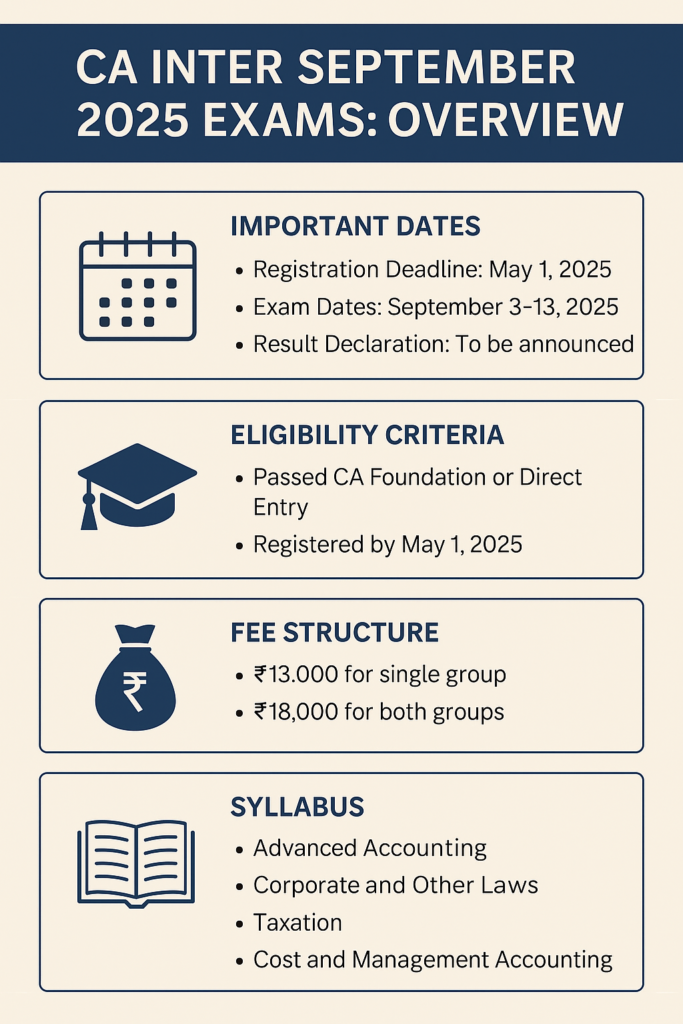

Important Dates for CA Inter September 2025 Exams ⏳

| Event | Expected Date |

|---|---|

| Registration Start Date | March 2025 |

| Last Date for Registration | May 2025 |

| Admit Card Release | August 2025 |

| Exam Dates | September 2025 |

| Result Declaration | November 2025 |

(Dates are tentative; refer to the official ICAI website for updates.)

Eligibility Criteria for CA Inter ✅

To appear for CA Inter September 2025 Exams, candidates must fulfill one of the following conditions:

✅ Passed CA Foundation (or its equivalent)

✅ Direct Entry Route:

- Graduates (min. 55% in Commerce) 🎓

- Postgraduates (min. 55% in any stream) 🎓

- Cleared the Intermediate level of ICSI/ICMAI

CA Intermediate Exam Fees (2025) 💰

| Category | Fee (INR) |

|---|---|

| Single Group | ₹1,500 |

| Both Groups | ₹2,700 |

| Late Fee (if applicable) | ₹600 |

(Fees may vary; check ICAI Fee Structure

CA Intermediate Subjects & Syllabus (Group 1 & Group 2) 📖

Group 1 Subjects

| Subject | Marks | Key Topics |

|---|---|---|

| Accounting | 100 | Accounting Standards, Partnership, Companies |

| Corporate Laws | 100 | Companies Act, SEBI Regulations ⚖️ |

| Taxation | 100 | Income Tax, GST 💸 |

| Cost & Management Accounting | 100 | Costing Methods, Budgeting 📊 |

Group 2 Subjects

| Subject | Marks | Key Topics |

|---|---|---|

| Advanced Accounting | 100 | Consolidation, Banking Companies 🏦 |

| Auditing | 100 | Standards, Internal Audit 🔍 |

| Enterprise Info. Systems | 100 | ERP, Data Analytics 📈 |

| Financial Management | 100 | Capital Structure, Risk Management 💹 |

📌 Download Full Syllabus: ICAI CA Intermediate New Syllabus

Detailed Syllabus for CA Inter September 2025 Exams 📖

The ICAI has revised its syllabus to align with global standards and industry requirements. Here’s a concise overview of the detailed syllabus for each paper. For the most granular details, always refer to the official ICAI Study Material. 📘

Group I

Paper 1: Advanced Accounting

- Introduction to Accounting Standards: Overview, Applicability, Presentation & Disclosures, Assets, Liabilities, Revenue, and other Accounting Standards.

- Financial Statements: Preparation of Financial Statements of Companies, Cash Flow Statement.

- Specialized Accounting: Buyback of Securities, Amalgamation of Companies, Internal Reconstruction, Accounting for Branches (including Foreign Branches), Consolidated Financial Statements (AS 21, 23, 27).

Paper 2: Corporate and Other Laws

- Part I: Company Law and Limited Liability Partnership Law (70 Marks) ⚖️

- The Companies Act, 2013: Preliminary, Incorporation, Prospectus, Share Capital and Debentures, Acceptance of Deposits, Registration of Charges, Management and Administration, Declaration and Payment of Dividend, Accounts of Companies, Audit and Auditors, Companies Incorporated Outside India.

- The Limited Liability Partnership Act, 2008.

- Part II: Other Laws (30 Marks)

- The General Clauses Act, 1897

- Interpretation of Statutes

- The Foreign Exchange Management Act, 1999

Paper 3: Taxation

- Section A: Income Tax Law (50 Marks) 📊

- Basic Concepts, Residence, and Scope of Total Income

- Heads of Income (Salaries, House Property, PGBP, Capital Gains, Other Sources)

- Income of Other Persons Included in Assessee’s Total Income (Clubbing)

- Aggregation of Income, Set-off and Carry Forward of Losses

- Deductions from Gross Total Income

- Computation of Total Income and Tax Liability

- Advance Tax, TDS, TCS, Returns of Income.

- Section B: Goods and Services Tax (GST) (50 Marks) 🧾

- GST in India – An Introduction

- Supply under GST, Charge of GST, Place of Supply

- Exemptions from GST, Time of Supply, Value of Supply

- Input Tax Credit, Registration, Tax Invoice, Credit and Debit Notes

- Accounts and Records, Payment of Tax, Returns.

Group II

Paper 4: Cost and Management Accounting ➕➖✖️➗

- Introduction to Cost and Management Accounting

- Material Cost, Employee Cost, Direct Expenses, Overheads

- Activity Based Costing (ABC), Cost Sheet, Cost Accounting Systems

- Methods of Costing: Unit & Batch Costing, Job Costing, Process & Operation Costing, Joint Products and By Products, Service Costing.

- Cost Control and Analysis: Standard Costing, Marginal Costing, Budgets and Budgetary Control.

Paper 5: Auditing and Ethics 🕵️♀️

- Nature, Objective and Scope of Audit

- Audit Strategy, Audit Planning, and Audit Programme

- Risk Assessment and Internal Control

- Audit Evidence, Audit of Items of Financial Statements

- Audit Documentation, Completion and Review

- Audit Report, Special Features of Audit of Different Types of Entities

- Audit of Banks

- Ethics and Terms of Audit Engagements.

Paper 6: Financial Management & Strategic Management 📈🎯

- Section A: Financial Management (50 Marks)

- Scope and Objectives of Financial Management

- Types of Financing

- Financial Analysis and Planning – Ratio Analysis

- Cost of Capital, Financing Decisions – Capital Structure, Leverages

- Investment Decisions, Dividend Decision

- Working Capital Management: Introduction, Treasury and Cash Management, Management of Inventory, Receivables, Payables, Financing of Working Capital.

- Section B: Strategic Management (50 Marks)

- Introduction to Strategic Management

- Strategic Analysis: External Environment, Internal Environment

- Strategic Choices, Strategy Implementation and Evaluation.

Preparation Tips for CA Inter September 2025 💡

Mock Tests: Take mock tests seriously to assess your preparation level and manage time effectively. ⏱️

Start Early: Given the vast syllabus, early preparation is crucial. ⏳

Conceptual Clarity: Focus on understanding concepts rather than rote learning. 🤔

Practice Regularly: Solve numerous problems, especially from previous year’s papers and ICAI mock tests. ✍️

Create a Study Schedule: Allocate dedicated time for each subject and topic. 🗓️

Revision is Key: Regular revision helps in retaining information. 🔄

Stay Updated: Keep an eye on ICAI announcements for any syllabus or exam pattern changes. 📢

Exam Pattern & Passing Criteria 📝

- Mode: Pen & Paper (Offline) ✍️

- Duration: 3 hours per paper ⏳

- Passing Marks:

- Minimum 40% in each subject 📉

- Aggregate 50% in each group 📊

Preparation Tips for CA Inter Sep 2025 Exams 🚀

- Follow ICAI Study Material – Stick to official books. 📚

- Practice Past Papers – Solve at least 5 years’ papers. 📑

- Take Mock Tests – Improve time management. ⏱️

- Focus on Amendments – Especially in Tax & Law. 🔄

- Join a Coaching (if needed) – For doubt clearance. 🎓

Conclusion 🏁

The CA Inter September 2025 Exams require disciplined preparation and a clear understanding of the syllabus. Stay updated with ICAI notifications and follow a structured study plan.

Need help? Drop your questions in the comments! 💬

FAQs (CA Intermediate Exams September 2025)❓

Q1. Can I apply for a single group in CA Inter?

✅ Yes, you can choose either Group 1 or Group 2.

Q2. What if I fail one group in CA Inter?

🔄 You can reappear for the failed group while keeping the passed group’s marks.

Q3. Is there negative marking?

❌ No, ICAI does not deduct marks for wrong answers.

Good luck with your CA Intermediate journey! 🎉🚀